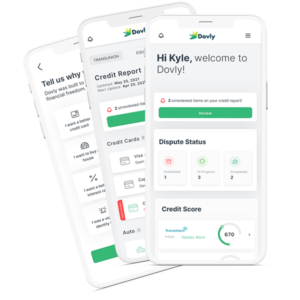

Dovly is an automated credit repair engine that tracks, manages, and fixes consumer credit. “Our proprietary algorithm identifies the issues and automates the credit report dispute process, utilizing an approach that is proprietary customized at the individual level for optimal impact,” says Nirit Rubenstein, CEO and co-founder, explaining, “My co-founder and I both immigrated to the U.S. as children and witnessed first-hand the challenges our families faced lacking access to credit. As we were building our careers in the financial services and technology sectors, we decided there had to be a better way to solve a problem that is impacting the financial well-being of tens of millions of Americans.”

is an automated credit repair engine that tracks, manages, and fixes consumer credit. “Our proprietary algorithm identifies the issues and automates the credit report dispute process, utilizing an approach that is proprietary customized at the individual level for optimal impact,” says Nirit Rubenstein, CEO and co-founder, explaining, “My co-founder and I both immigrated to the U.S. as children and witnessed first-hand the challenges our families faced lacking access to credit. As we were building our careers in the financial services and technology sectors, we decided there had to be a better way to solve a problem that is impacting the financial well-being of tens of millions of Americans.”

But the problem they wanted to address went deeper than just access to credit. “We were up against the reputational challenge the entire industry has created over decades,” she says. The predatory methods of the traditional credit repair industry have made “credit repair” a dirty word in the minds of regulators and consumer advocates. Describing incumbents as “mostly disreputable businesses that take advantage of financially vulnerable consumers, strong-arming them into unaffordable service plans that do little to advance the consumers’ credit or financial positions,” Rubenstein says, “We’ve worked hard to show that Dovly puts the consumer first, offering a technology-enabled solution that is transparent, legally compliant, affordable, and effective. This approach has helped us earn the trust of business partners and consumers who would otherwise steer clear of the industry.”

Their purpose, she says, is to make a positive difference in each customer’s life. So, as the company grows, “We hire people who understand that every decision we make [must consider], ‘What will this do for our members?’

“In other words,” she continues, “we are changing the narrative. By showing people how we’re different — that we’ve truly got their backs — we are serving and creating a new market, one that is an order of magnitude broader than the universe of people who would traditionally turn to credit repair. We make things a lot easier, so that anyone who needs our help can get it, increasing financial inclusion for the large segments of our population that otherwise cannot access critical products and services.”

Recognizing that building a brand takes time, Rubenstein says, “Someone once told me to remember that things are never as good as they seem or as bad as they seem. I’ve taken that message to heart, keeping an even keel in the face of so many ups and downs – often in the same hour! Things can go wrong, but if we stay true to our mission, we’ll succeed in the long run.”

Did You Know: The problem of inaccurate data is only getting worse. According to Dovly CEO Nirit Rubenstein, a story in Forbes earlier this year reported that credit report inaccuracies more than doubled during the pandemic — largely because of a mismatch between laws that were meant to give consumers relief and mistakes made in the way suspended payments were reported to the credit bureaus.

Speak Your Mind

You must be logged in to post a comment.